FEBRUARY 2024

The Private Equity Energy Tracker

NEW DATABASE

A groundbreaking, searchable list of recent energy holdings of eight of the top North American private equity firms

Read More

The Private Equity Climate Risks project investigates the role of the private equity industry in the climate crisis.

About

Selected Reports

View all reports by the Private Equity Climate Risks here.

2022 SCORECARD & REPORT

Private Equity Climate Risks 2022 Scorecard & Report

This scorecard and report reveals the top eight private equity firms invested in oil and gas and includes a set of demands to hold private equity accountable.

The firms analyzed in the scorecard are The Carlyle Group, Warburg Pincus, KKR, Brookfield Asset Management, Ares Management, Apollo Global Management, The Blackstone Group, and TPG.

2023 REPORT

Uncovering KKR’s Environmental Responsibility Gap

KKR might claim to prioritize environmental responsibility, but with a staggering 78% of their energy portfolio companies rooted in fossil fuels, the numbers tell a different story.

This report spotlights three prominent KKR gas investments, showcasing a pattern of repeated environmental violations, failure to obtain community consent, a lack of accountable business practices, and significant cost overruns.

Major private equity firms have invested over

$1 trillion

in energy since 2010, with the lion’s share in fossil fuels

78% of KKR’s energy portfolio companies invest in fossil fuels, with at least

$9 billion

in gas and LNG transportation and storage

Power plants owned by Carlyle emitted roughly

14 million

metric tons of CO2e in 2021

2023 REPORT

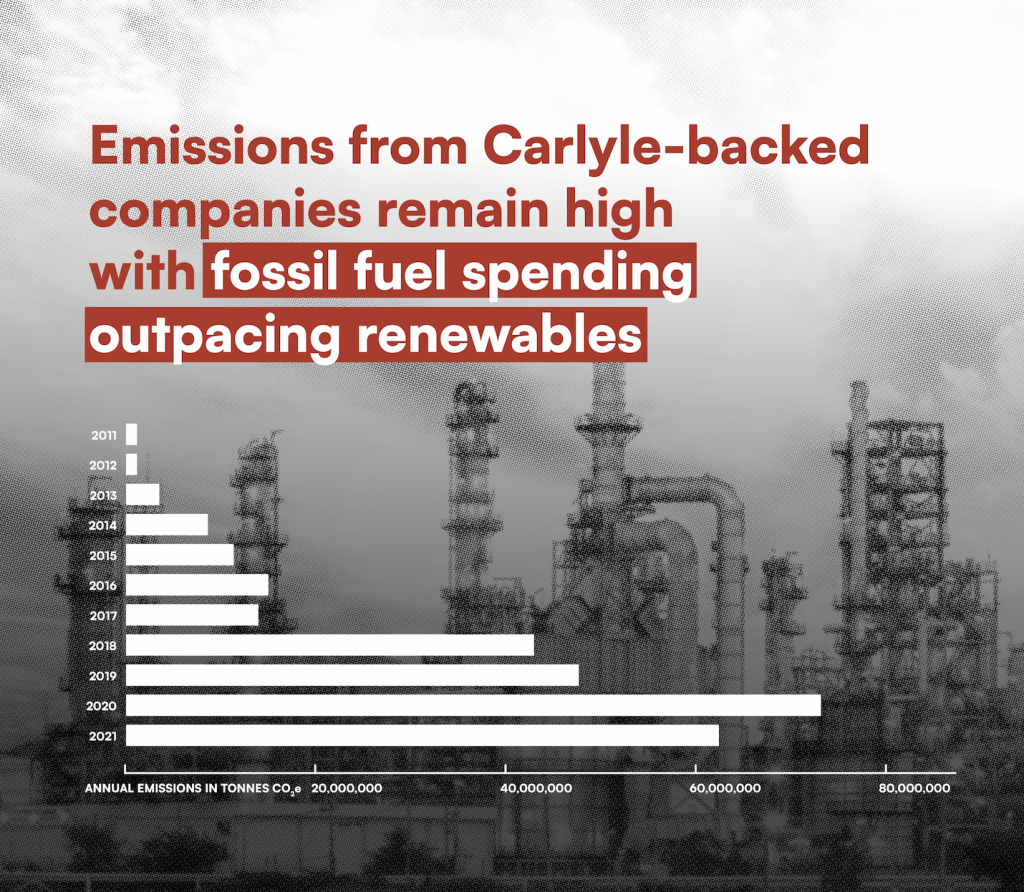

Exposing a decade of Carlyle’s fossil fuel investments

As one of the world’s largest private equity firms, The Carlyle Group invests heavily in fossil fuels, despite the urgent need to transition to renewable energy. For every $1 invested in renewable energy, Carlyle invests $16 in fossil fuels, exacerbating the global climate crisis.

Carlyle’s energy investments from 2011-2021 is heavily skewed toward fossil fuels with $22.4 billion in carbon-based energy and only $1.4 billion in renewables. This resulted in an estimated 277 million metric tons of CO2 emissions, which would take 4.6 billion newly planted trees ten years to remove.

Learn more about the financial and reputational risks of Carlyle’s fossil fuel investments and their impact on the planet and communities.

2023 REPORT

Brookfield’s Climate Paradox: Climate Pledges vs. Fossil Fuel Reality

This report highlights a stark discrepancy between Brookfield’s reported emissions and its actual carbon footprint. Its current fossil fuel investments emit nearly 159 million metric tons of CO2 equivalent (CO2e) a year, much of that through its ownership of Oaktree Capital, a private equity firm with $183 billion in assets. This emissions figure is nearly 14 times higher than the figures Brookfield discloses in its most recent sustainability report.

The report is written by the Private Equity Stakeholder Project, Americans for Financial Reform Education Fund, and Global Energy Monitor.

DEMANDS FOR PRIVATE EQUITY

Society can’t afford to let private equity continue to pollute under the shroud of darkness and put people’s retirement at risk. The policymakers and regulators who govern financial markets, and private equity investors, must require comprehensive disclosures and plans to transition out of fossil fuels.

- Align with Science-Based Climate Targets To Limit Global Warming To 1.5⁰C

- Disclose Fossil Fuel Exposure, Emissions, and Impacts

- Report Portfolio-Wide Energy Transition Plan

- Integrate Climate And Environmental Justice

- Provide Transparency On Political Spending And Climate Lobbying

Press

Subscribe for updates